Institutional Investors Cut Down on Shorting Bitcoin; Start of the Next Bull Run?

As we come to the end of the month, Bitcoin is trading above $11,500, capping at +2% returns, and +27% in Q3.

It has been after a week that the digital asset went above $11,700 today, but ‘real’ spot volume is still low at just $1 billion.

“High time frames on Bitcoin looks good. The weekly candle shows that buyers were interested in sub $11,550,” said trader Josh Rager. “There isn’t much holding Bitcoin between the current price and $13ks on high time frames. I personally think it’s time BTC makes way for $12k+ again,” he said.

An upwards momentum in BTC price has also reflected in altcoins with Ether surging above $420 and Litecoin up 5.44%.

But it has been DeFi tokens that are enjoying a rally. With 37% gains, UMA made it to the 25th spot with a nearly $1 billion market cap. YFI, meanwhile hit yet another new all-time high at $37,621 yesterday.

A Winning Streak

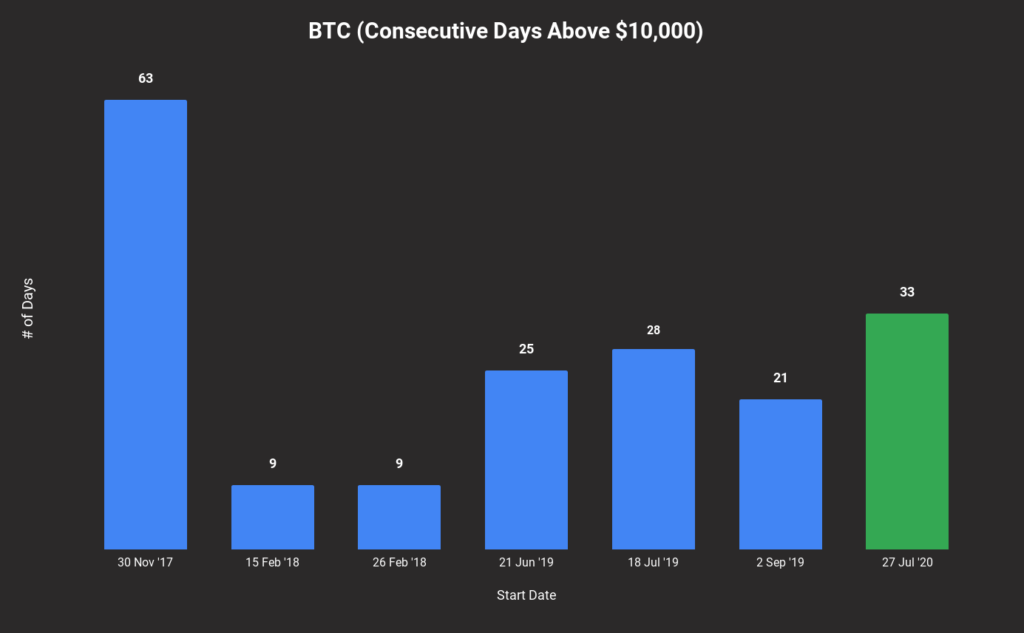

Bitcoin is taking its sweet time to move further, but the largest digital asset is currently strengthening its position above the psychologically important $10k level. BTC is actually in its longest streak of consecutive days of above $10,000 since breaking this level during the last bull run while on its way to the ATH.

Another interesting and bullish facet bitcoin is enjoying is the active addresses on the network, which is reaching $1 million.

In Bitcoin’s history, there have been only 69 days when active addresses have been more than 1 million, and three of those days were in the summer of 2019, while 23 occurred in the summer of 2020.

Shorts are Now Short

This month, bitcoin has been all about ranging between $11,000 and $12,000, building the stage for its bull run. 2020 already had bitcoin reward halving, which historically has led to, in about 1.5 years to the event, new peaks for Bitcoin.

Moreover, bitcoin is making its way to the company’s’ balance sheet, replacing cash as the reserved asset. Publicly traded company MicroStrategy bought $250 million worth of BTC while two other small businesses, Tahini restaurant, and software startup Snappa also converted their reserve into Bitcoin.

This has been thanks to Fed’s monetary and fiscal stimulus that has been pushing the US dollar down. Recently, the central bank also declared that they would let the inflation run above its 2% target.

As a matter of fact, the Fed currently owns a total of 22,913 securities and is the world’s biggest investor.

Not to mention the new retail interest driven by the DeFi mania and Dave Portnoy, who got reportedly rekt after buying the top and selling the bottom. However, he hasn’t left crypto yet and is apparently figuring out the market.

Not just retail but institutional investors are also here big time. This month, Bakkt hit new records in volume, and CME saw record open interest in bitcoin futures.

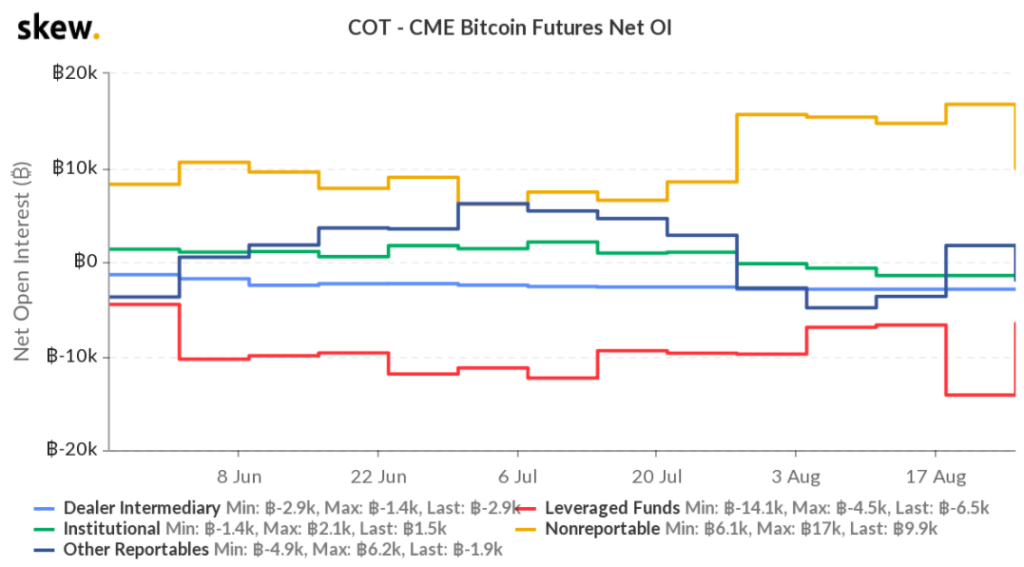

While CME Open Interest experienced its sharpest one-week OI decline this past week since BTC futures were launched, shedding nearly 3000 contracts in total, “asset managers nearly completely exited their short positions,” and Leveraged Funds also reduced their short exposure, which means they are also optimistic about the market.

The long position of asset manager remains unchanged at 296. Still, short positions have plummeted from 585 to 1. “We believe this reflects profit-taking with shorts being closed, as well as confidence in Bitcoin’s short-term appreciation,” said OKEx.

The latest COT report shows hedge funds short of CME bitcoin futures more than halved over the last week. “The hunt for yield through cash & carry has been a key driver of futures trading recently. The recent pullback in rates led to position unwinds,” noted Skew.

Source: bitcoinexchangeguide.com