How To Make $80,000 In Crypto Profits And Pay Zero Tax

Cryptocurrencies like bitcoin are treated as “property” per IRS rules (IRS Notice 2014-21). When you trade cryptocurrency for a profit, you end up having to pay taxes on the resulting capital gains. The capital gains (profit) is the difference between how much you paid for the cryptocurrency (the cost basis) and how much you sold it for (proceeds).

Under the current tax code, the federal income tax rate you have to pay on these crypto profits could go as high as 37%. However, with a little tax planning, you can greatly reduce that amount, and even bring it down to $0.

How You Can Get The 0% Tax Rate For Crypto

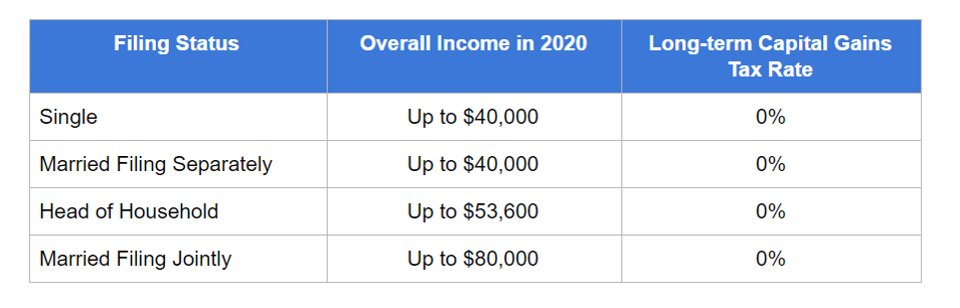

For the savvy taxpayer, there is a legal way to reduce taxes to zero on thousands of crypto profits. The eligibility for this 0% tax rate depends on your filing status, annual income you make, and how long you kept the cryptocurrency before selling it. The following chart shows you a summary of these three variables and its correlation with the zero tax rate.

Let’s look at an example. Imagine Violet is a full-time college student who purchased 10 bitcoin (BTC) at $100 each in 2013. She currently does not have a job or any other sources of income. Her filing status is single. Assume the price of BTC in 2020 is $10,000. In 2020, Violet can sell 4.04 BTC and incur approximately $40,000 (4.04 BTC * ($10,000 – $100)) of long-term capital gains without having to pay any taxes on that income.

Furthermore, she can continue to liquidate her position in the coming years while making sure that her overall income always stays under the 0% capital gain tax rate threshold. With careful tax planning like this, Violet can effectively cash out all her BTC without paying a single dime on taxes. Even if she is not eligible to get the 0% tax rate for crypto in future years, the maximum amount of long-term capital gain tax rate she will ever be subject to is capped at 20% because she kept the cryptocurrency for more than 1 year.

Source: forbes.com