Here’s Why a Wall Street Vet Says “Everything” is an Inferior Trade to Bitcoin

Raoul Pal, the CEO of Real Vision, said in a recent interview that he thinks “no trade matters except for Bitcoin” at this moment. He added that “almost everything is an inferior trade” to the cryptocurrency.

This comes shortly after he said that the ongoing money printing is making him more bullish on Bitcoin than ever before:

“In fact, only one asset has offset the growth of the G4 balance sheet. Its not stocks, not bonds, not commodities, not credit, not precious metals, not miners. Only one asset massively outperformed over almost any time horizon: Yup, Bitcoin. My conviction levels in bitcoin rise every day. Im already irresponsibly long. I am now thinking it may not be even worth owning any other asset as a long-term asset allocation, but that’s a story for another day (I’m still thinking through this).”

Pal isn’t the only macro analyst to have been pledging their support for Bitcoin over recent months.

Lyn Alden, the founder of Lyn Alden Investment Strategy, recently shared three reasons why she has allocated capital to BTC. They are as follows:

- Bitcoin’s network effects have allowed it to outpace altcoins, which could have suppressed BTC.

- Bitcoin has scarcity mechanisms such as block reward halvings.

- The cryptocurrency has an “ideal” macro backdrop, which includes massive growth in money supply and the mainstream adoption of the asset by prominent firms.

WHERE COULD BTC RALLY IN THE LONG RUN?

Pal thinks that Bitcoin could gain at least one order of magnitude in the upcoming bull cycle, announcing this target in a number of threads and interviews.

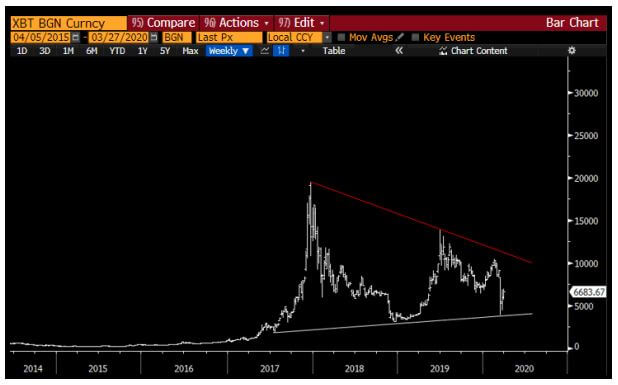

In an April newsletter, he wrote in reference to the price of BTC’s price action seen below:

“The chart is spectacular… I think it hits $100,000 in the next two years alone. But it could go to $1m in the same time period.”

In an interview with Max Keiser, Pal also mentioned there is a potential for Bitcoin to become a $10 trillion asset in the next decade.

Source: bitcoinist.com