Bitcoin Defends $11,100 While Large-Cap Altcoins Struggle

Despite Bitcoin’s tumultuous performance following an announcement of the US Federal Reserve regarding its new approach to average inflation targeting, the cryptocurrency has managed to stabilize around $11,400 where it’s currently trading at.

Elsewhere, Chainlink and Polkadot are both in red but LINK has returned to the top 5 coins by market cap.

Bitcoin Spikes And Drops

As CryptoPotato reported yesterday, the US Federal Reserve announced new plans to target inflation averaging 2% over time. While some may have expected this, the news had an immediate effect on prices among all financial markets.

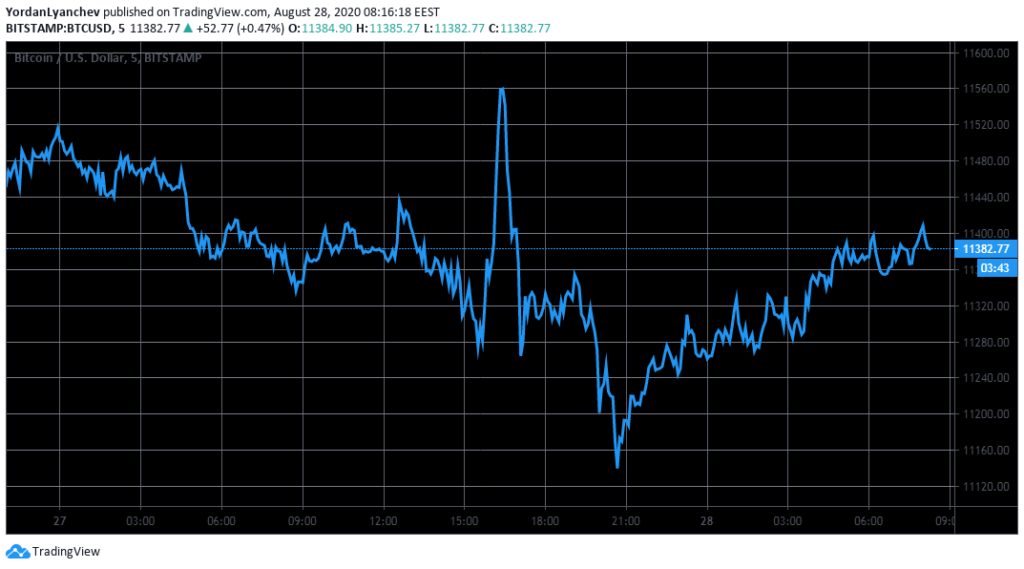

Bitcoin went rapidly from below $11,300 to an intraday top just shy $11,600. As sharp as the pump was, a drop followed just as vigorously, and BTC bottomed at about $11,100.

The cryptocurrency has recovered since the daily low and is currently trading at $11,400. Should another price dip materialize for BTC, it would have to rely on $11,200, $11,100, and $11,000 as support.

In case the asset emerges upwards, it needs to overcome the significant resistance at $11,800 before having a chance to face-off with the psychological $12,000 level.

Other financial markets experienced similar price developments as Bitcoin and gold is no exception. The precious metal pumped from $1,930 per ounce to above $1,970 following the Fed news and then bottomed at $1,915 minutes after. Nevertheless, similarly to BTC, gold has recovered and is back at $1,940/oz.

Chainlink Returns To #5, Low-Cap Alts Fluctuate Massively

Despite being 2.5% down and below $15, Chainlink has climbed one spot in terms of market capitalization. Polkadot’s weekly impressive gains resulted in DOT’s market cap exceeding that of LINK. Today, however, DOT retraces by 5% to below $6, and LINK has become the 5th largest digital asset, according to CoinGecko.

Ethereum is one of the few larger-cap alts in the green today after a 1.4% increase to $391. Another major exception comes from Binance Coin (3% up). BNB trades now at above $23 as the leading cryptocurrency exchange’s futures platform announced a DeFi Composite Index Perpetual Contract with up to 50x leverage.

The rest of the top 10 coins are bleeding out – Ripple (-3%), Bitcoin Cash (-2%), Litecoin (-2%), BitcoinSV (-1.6%), and Crypto.com Coin (-1%).

The most notable fluctuations in either direction are evident among lower-cap alts. Numeraire leads the green part with a nearly 50% surge, followed by UMA (30%), Serum (26%), Synthetix Network (12%), and THORChain (11%).

On the other hand, Aragon loses the most substantial chunk of value after an 18% drop, followed by Flexacoin (-11%), Ren (-9%), NXM (-9%), and Nervos Network (8.5%).

Source: cryptopotato.com