Bitcoin Bull Markets Show Increasing Traction Among Altcoins

Most of the users who buy Bitcoin on Coinbase end up switching to an alternative currency, especially when BTC starts a “bull run”, according to a Coinbase report.

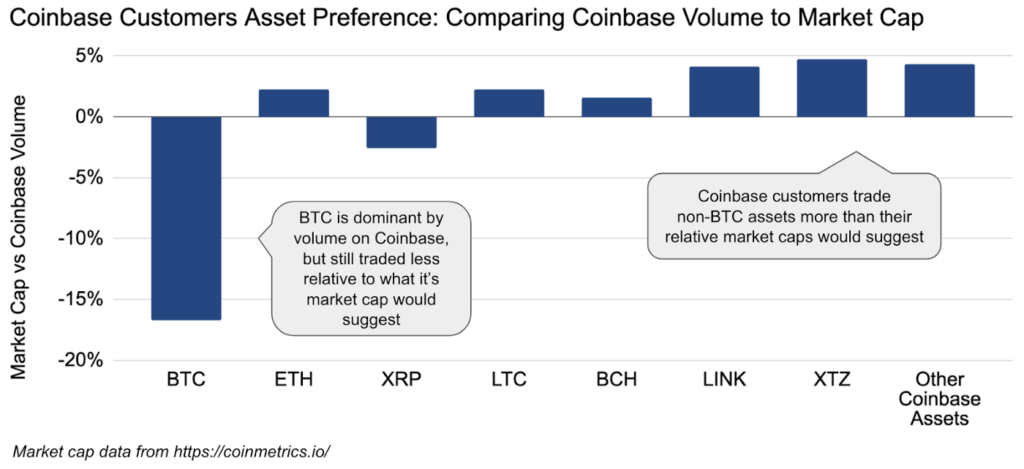

Users trade BTC for Altcoins looking to boost profits

According to Coinbase, this could be because traders feel confident about their investments in Bitcoin and look for higher returns by operating with altcoins, which attract traders for their much higher volatility and bigger risk/reward ratio.

“(There is) a trend where bull markets show increasing traction among alternative assets…As people feel good about their initial crypto investments (into Bitcoin), they branch out to find other possible categorical winners (as evident in the 2017 bull run). The converse is also possible, as prices drop and fear grips the market (2018-2019) “

Bitcoin lost much of its dominance in 2017 following the ICO boom, however, it was able to recover it during 2018-2019.

Coinbase boosted the altcoin trading practice after it expanded its list of supported assets by including a lot of new tokens during the famous alt-season. This is of particular importance since Coinbase was previously known for its restricted number of supported assets.

“This trend first appeared in 2017, and is now evident in large spikes. Notably in late 2019 (with Tezos, Chainlink, BAT, 0x, and Stellar) and again in early 2020 (driven by Ethereum, Tezos, and Chainlink).” Coinbase said.

Bitcoin remains the leader in market cap and it is the first contact of new users with the world of cryptocurrencies, so Bitcoin will remain as the number one in crypto space for a long time to come, as long as it continues to serve as a link between the altcoins and the fiat world.

However, it seems that Bitcoin is regaining the trust of the new —and old— investors. The token has recovered from the bottom zone of almost 4,000 USD when it followed the traditional markets during the infamous “Black Friday”. This has solidified its status as a legitimate store of value, and a great trading asset, which has been described as even more profitable than gold by many traders and experts from around the world.

Yesterday, Bitcoin reached $9,940 at its peak, correcting to $9,700 the price it is currently holding while it seeks to break the $10,000 barrier that seems to be anchored in its prices since April.

Also, it is worth mentioning that the number of unique addresses (a sign of true adoption) has been systematically increasing over the last 3 months, so perhaps BTC users are seeing it more as a substitute for money instead of just an asset to speculate with.

source: zycrypto.com