$1 Billion Bitcoin Options Expire Tomorrow: Upcoming Showtime For BTC Price?

The notional value of Bitcoin options contracts set to expire tomorrow has reached a new record by exceeding $1 billion. With such a massive amount, the question remains how and if it will impact the price of the primary cryptocurrency.

BTC Option Contracts To The Moon

As CryptoPotato reported shortly after the mid-March panic sell-offs, Bitcoin options trading volume was declining, especially on regulated exchanges. However, the tide has turned since then, according to the cryptocurrency monitoring resource Skew.

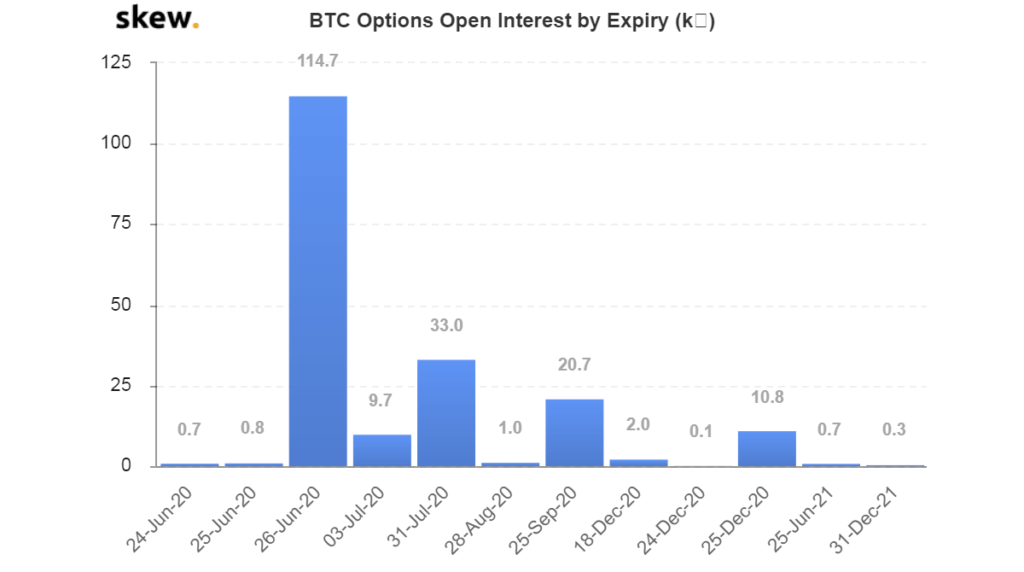

It outlines that there are 114,700 BTC options contracts set to expire tomorrow – June 26th. With the asset price hovering just below $9,300 at the time of this writing, this amount exceeds $1 billion in notional value. This is considerably higher than previous records and upcoming expiration dates.

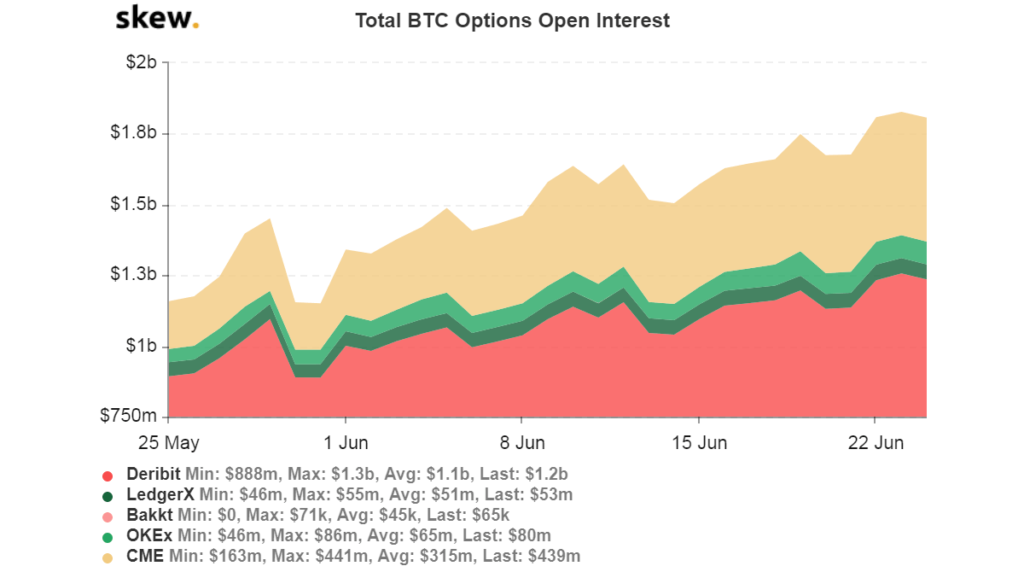

Another data set worth following is the open interest. It represents the total number of open positions, regardless of whether they are long/call or shot/put, by market participants at a given time. Additional data from Skew showcases which cryptocurrency exchanges are responsible for the most substantial OI.

Deribit has the largest market share in terms of open interest and expiring contracts. Luuk Strijers, Chief Commercial Officer at the exchange, told that these results reaffirm the direction chosen by the company to focus on this specific asset class.

“In traditional markets options volumes are relatively much higher compared to the volumes we see today and we expect over time the same to happen in crypto options. More and more traditional institutional investors are entering the market and they tend to prefer products they are familiar with.”

– added Strijers.

Interestingly, two regulated exchanges, namely the Chicago Mercantile Exchange (CME) and LedgerX, also have a notable open interest share, while Bakkt’s numbers are rather unimpressive.

Bitcoin options are a form of derivatives contracts allowing but not obliging investors to buy or sell the asset at a predetermined price on or before a specific date. If the investors have chosen a call option, it means they have the right to buy, while the put option allows them to sell.

What’s To Happen With BTC’s Price?

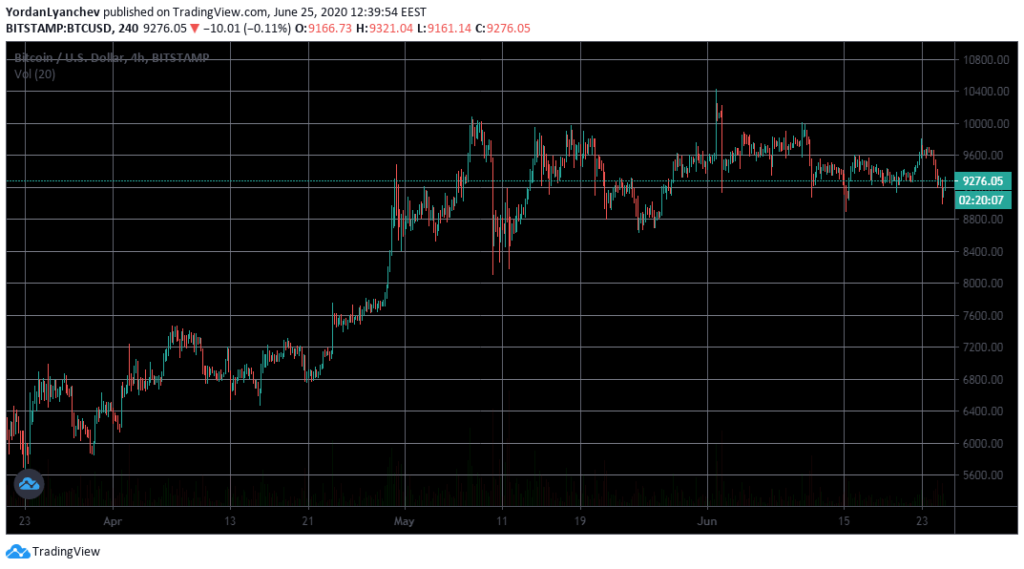

The primary cryptocurrency has been trading primarily in a range from $9,000 to $10,000 ever since the third halving in mid-May. Most recently, it jumped to $9,600 a few days ago before dipping briefly below $9,000 today.

The latest adverse price development raised speculations on the possible reasoning. Aside from miners sending massive BTC portions to exchanges, another theory is linked with the $1 billion worth of options contracts expiring tomorrow.

While it’s uncertain in which direction the price of BTC will head, the pressure of such a significant amount could increase the volatility rates towards a massive move.

History shows a similar occurrence from March this year. On the 27th, 50,000 Bitcoin options contracts expired, and the asset price was trading at about $6,800 a day prior. Shortly after the expirations of the contracts, BTC headed south and nosedived to $5,800.

Now, the amount of such contracts is more than twice as much, meaning that the consequences for the largest cryptocurrency could be even more notable.

From a technical standpoint, BTC can rely on the first support level at $8,900 – $9,000. If broken, then follows the May 25th low of $8,650. If the asset is to head north, it has to overcome the first resistance at $9,400, followed by $9,600.

Source: cryptopotato.com