Bitcoin golden cross could trigger rally to $13,800

Here is what you need to know on Tuesday Markets:

The cryptocurrency market is in the red two days in a row. On Monday, Bitcoin tried to overcome the seller congestion zone at $10,000. However, the price action hit a wall at $9,957 (current week high). Selling activities have dominated the market since then with Bitcoin bulls battling to keep the price above $9,500.

As the European session begins, Bitcoin is trading 1.89% lower on the day. The granddaddy of digital assets adjusted from $9,725 (opening value) to $9,533 (prevailing market value). BTC/USD is facing expanding volatility and a bearish trend according to the cryptocurrencies live rates.

Looking at the daily chart, Bitcoin is still holding within an ascending channel despite the retreat from $10,000. Moreover, a golden cross is likely to come into play with the 50-day SMA crossing above the 200-day SMA. With the proper volume, Bitcoin could rally above $10,000, renewing the desire to beat 2019 high at $13,800.

Ethereum is struggling to balance above the short term support at $210. The second-largest cryptoasset is trading 1.86% lower after a correction from $214.77 (opening value) to $210.79 (prevailing market value). Like Bitcoin, Ether is also dealing with increased seller activity amid expanding volatility. If the price fails to hold above $210, $200 is the next support target.

XRP/USD has not been spared as it has lost 1.7% of its value. Ripple has, however, managed to hold above the critical $0.20 support. On the upside, movements are capped at $0.21. The consolidation above $0.20 could allow buyers to gather strength as they wait for a technical breakout.

Among the top 100 cryptocurrencies, the best performing assets include Metaverse Dualchain Network Architecture (up 9.60%), Baer Chain (up 8.79%), MonaCoin (up 9.59%) Electroneum (12.14%) and Steem (up 17.90%) in the last 24 hours. On the other hand, some of the worst-performing cryptos include HEX (down 18.18%), MINDOL (down 1564%), DigiByte (down 10%) and Elamachain (down 10%).

Chart of the day: BTC/USD daily

Market

Chainlink, one of the fasted growing cryptocurrency projects has signed a partnership deal with South Korea’s Kakao affiliate firm, Klatyn. Klatyn is the firm behind the development of KakaoTalk, a popular mobile messaging app in the Asian region. The partnership seeks to integrate Chainlink’s oracles with Klatyn’s smart contracts. According to Klaytn’s CEO, Sangmin Seo:

Chainlink can provide Klaytn with a secure oracle framework for building blockchain applications that interoperate with traditional infrastructure, increasing our capacity to develop more advanced products across a more diverse set of markets.

At the time of writing Chainlink is trading 2% lower on the day and has a market value of $3.82. While the partnership news was well received by LINK’s community, the price is yet to react upwards. Instead, LINK is caught up in the market’s general bearish trend.

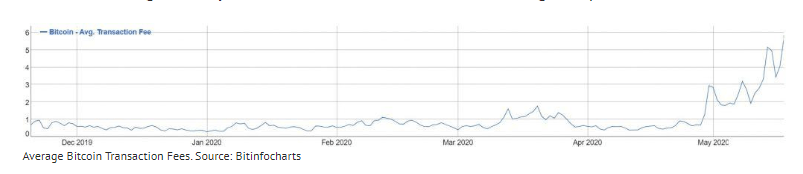

Bitcoin transaction fees skyrocket after halving

Bitcoin’s third halving took place without the hype of a price rally. However, experts still believe that a halving rally is still possible towards the end of the year. However, what is apparent is the rising transaction fee in the Bitcoin network. Analyzed data onBitInfoCharts has shown that the fee has hit 11 months high ($5.82 on Monday). The surge has been gradual since January 2020 but spiked in the last three weeks. As transaction fee hikes, users are likely to seek alternatives Ethereum and Ripple which eventually could affect Bitcoin’s performance.

Industry

In an announced via Twitter on Monday, Square and Twitter CEO Jack Dorsey revealed that Cash App users have the ability to set their recurring Bitcoin purchases ranging from daily, weekly, or bi-weekly. The set minimum is $10 on all the three schedules. Another new feature that was announced was the ability of users to change the balance display from BTC to Satoshis (sats). The recurring purchases feature has come at a time when people are focusing on “Hodling;” buying to keep for a long time.

Regulation

Japan’s cryptocurrency exchanges have started implementing changes in regards to the new crypto laws. The revised Payments Services Act (PSA) came into effect on May 1. Some of the changes start with amendment of all references to “virtual currency” to the term “crypto asset.” Exchanges also have to comply with the directive that users’ money is handled separately from the platforms’ cash flows.

source: fxstreet.com