How to choose cryptocurrencies for investment

Bitcoin is stable, Ethereum is set for a jump, Ripple confounds investors, and Chainlink is a rising star.

There are more than 1,600 cryptocurrencies in existence. We would all like to profit from the rapid appreciation that crypto is sometimes able to achieve, but how do we know we’re not putting our money into, to use a professional investment term, a shitcoin?

Any investment in crypto is high risk, but that doesn’t mean that you can’t manage the risk, just as a professional investor does. Good timing, combined with an understanding of the market will keep risk (almost) under control.

The place to start is with the so-called ‘majors.’ The best-known cryptocurrencies are also the largest store of value, meaning that the amount invested in them provides a level of security.

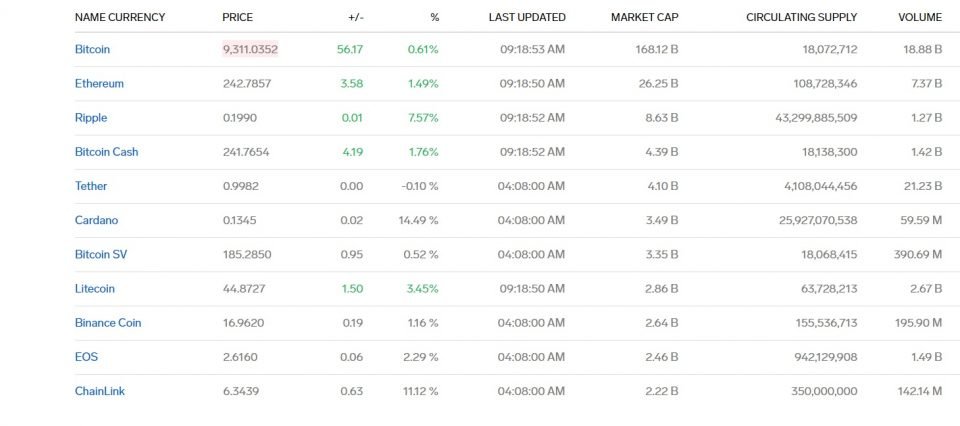

Bitcoin (BTC) now has a market cap of $168.2 billion. That’s about the equivalent of a company like Coca-Cola (currently at about $160 billion). That kind of cash doesn’t usually disappear overnight. So the price of a single Bitcoin, currently at about $9,400 per coin, could go down to about $5,000 as it did recently, but investors will hang on as they would to Coca-Cola stock when it drops to low points.

Then there is Ethereum (ETH), next in size in terms of market cap at about $30 billion, and also well-known for creating the ‘smart contract,’ a critical component of blockchains today. (Do not confuse Ethereum with Ethereum Classic which is a much less interesting variant). Back in 2017, an ether (the unit of Ethereum) was worth $30. The price reached $1,300 per ether at one time, but has since fallen back to about $250.

Investors in Ethereum say ‘just hold on no matter what,’ as they believe another swing towards $1,000 per coin is possible. There is good reason to believe this, because Ethereum is changing its method of verifying transactions on the blockchain from ‘Proof of Work’ to ‘Proof of Stake.’ Without going into detail, ‘Proof of Stake’ is more efficient and less costly, so the coin could well increase in value.

Next comes Ripple (XRP): If proof were needed to explain why cryptocurrencies don’t make sense, Ripple would be the perfect example. Ripple, the company, is today valued at $10 billion. The cryptocurrency XRP, which we often call Ripple, has a market cap of $8.63 billion. Ripple, the company, was created in 2012 with the ground-breaking idea of using XRP in bank-to-bank money transfers. SWIFT, which had a virtual monopoly on these transfers for decades, had become expensive and slow. Ripple’s disruption of the transfers beat SWIFT hands down.

Ripple, the company is clearly a success. But, in trading on the markets, XRP has been a dismal failure. Having risen as high as $3.84 per coin, XRP has sunk down to $0.19 at current levels, and seems unlikely to go much higher in the foreseeable future. No one seems to be able to give a convincing explanation for this; some analysts point to Ripple’s repeated sales of XRP as pushing the price lower, but the sales have tapered off, and the price remains low.

Cryptocurrencies overall have showed lacklustre performance this year, so we have to ask what merits attention in the future. Chainlink’s LINK is clearly a rising star, one of a handful of cryptocurrencies in which value is tied to the business case for the currency – these cryptos prove that Ripple hasn’t set the pattern, and that value creation matters.

Chainlink is a blockchain project that aims to build bridges between payment services like PayPal and Visa, banks and cryptocurrencies like Ethereum and Bitcoin.

Chainlink explains: “Smart Contracts provide the ability to execute tamper-proof digital agreements, which are considered highly secure and highly reliable. In order to maintain a contract’s overall reliability, the inputs and outputs that the contract relies on also need to be secure. Chainlinks provide a reliable connection to external data that is provably secure end-to-end.”

The connection to data is called an “oracle.” An oracle is an agent that finds and confirms real-world events and submits this data to a blockchain to the usage of smart contracts. Chainlink provides oracles that maintain security and function efficiently.

“Chainlink’s decentralized oracle network provides the same security guarantees as smart contracts themselves. By allowing multiple Chainlinks to evaluate the same data before it becomes a trigger, we eliminate any one point of failure and maintain the overall value of a smart contract that is highly secure, reliable, and trustworthy.”

Analysts agree: “Blockchain interoperability is the key to blockchain’s future success. Anyone with an API (software linkup code) can hook up with Chainlink’s oracles. This means everything from investment market data to bank account balances, product purchases, election results, and more can be recorded to the digital ledger,” note analysts at Cryptobriefing.

This has indeed proved a major success. After steep drop down to about $1.50 in March 2020 – as the crisis started – LINK has come back steadily to reach $5.37 at this writing. The current market cap is $2.22 billion, making it 11th in the list of major cryptocurrencies.

Another reason for the success of Chainlink is that it’s part of the growing decentralised economy – the so-called “Defi space.”

DeFi is an abbreviation of the phrase decentralized finance – blockchain-based financial software which relies on smart contracts and does not allow human intervention in its operations – an aspect which provides much greater security and efficiency. Defi applications called Dapps can be tacked together to perform very complex financial functions.

As Philip Sandner, of the Frankfurt School Blockchain Center explains: “True decentralization allows censorship resistance, worldwide participation regardless of social status and dispenses the need for trusted third parties (meaning human intervention).

Utilizing blockchain as technological infrastructure allows relatively speedy and low-cost transactions/settlement, the immutability of the financial contracts, and contract automation.”

The market cap for DeFi projects have quintupled in the last half year, and most of the ecosystem is now relying on (or planning to rely on) Chainlink for connecting on-chain DeFi smart contracts to off-chain data feeds like commodities and crypto price data,“ writes another analyst.

It’s often been observed that cryptocurrencies as a means of finance via the ICO seem to be on their way out, because of regulatory issues and simply because the business value of the project behind the currency often just isn’t there.

We all thought Ripple would be the counter-example, showing that a valid business using crypto for functionality would lead to higher coin prices.

Ripple would have proven us all wrong; companies like Chainlink show that this model is seeing success. In part 2, we’ll look at some other companies that provide value to back their cryptocurrencies.

Source: cyprus-mail.com