Bitcoin close to exploding to $13,000

- Bitcoin stalls under $9,200 but SalsaTekila, a pseudonymous analyst believes BTC/USD is heading to $13,000.

- BTC/USD could settle for consolidation based on the short term technical picture.

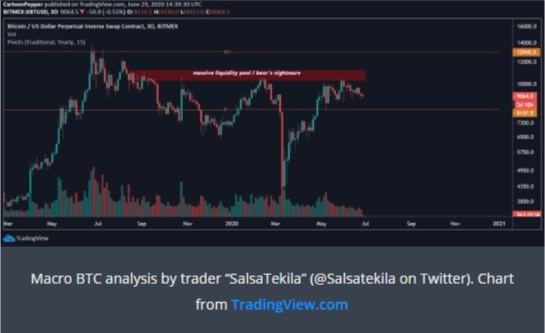

Bitcoin alongside other cryptocurrencies continues to encounter gruesome days. To many, the largest cryptocurrency has no fighting power left to rise above $10,000. However, there are some analysts who are choosing to remain bullish like the pseudonymous SalsaTekila. The analyst says that Bitcoin is “heading towards $13K mid-term. Massive liquidity pool around 10.5k, price tends to visit those sooner or later.”

Bitcoin technical picture

Bitcoin is trading at $9,168 at the time of writing. On the upside, $9,200 is the initial but key resistance. Note that, recovery from levels explored under $9,000 last week failed to sustain gains above $9,300. More hurdles are expected at $9,400, $9,500 and $9,600.

In addition, the price is trading below the 50-day SMA. Gains above this moving average could eventually catapult Bitcoin above $9,500; a move that could help shift the focus back to $10,000. On the flip side, support is expected at the former pivotal level $9,100. The buyer congestion at $9,100 is also in line to prevent losses into the $8,000’s range. If push comes to shove and BTC/USD spirals towards $8,000, the 200-day SMA ($8,483.35) could come in handy.

Technically, Bitcoin is entering into consolidation according to the RSI. The indicators is currently leveling at 48 after a minor recovery from levels around 40. The MACD also emphasizes that sideways trading would take precedence in the coming sessions. However, the MACD is in the negative region and features a small bearish divergence. In other words, sellers seem to have the upper hand. For now, keeping the price above $9,100 would give the bulls a chance to fight for $9,200.

BTC/USD daily chart

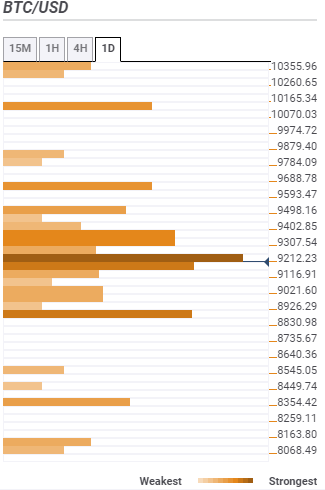

Bitcoin confluence resistance and support areas

Resistance one: $9,212 – This zone is home to the Bollinger Band 1-hour upper, the previous high 4-hour, previous high one-day and the Bollinger Band 4-hour upper.

Resistance two: $9,402 – The seller congestion zone is highlighted by the pivot one-day resistance two, the Bollinger Band one-day middle curve, the Fibo 38.2% one-month and the 100 SMA 4-hour.

Resistance three: 9,688 – This zone hosts the Fibo 23.36% one-month and the pivot one-week resistance one.

Support one: $9,116 – This buyer congestion zone highlights the SMA 200 15-minutes, the Bollinger Band 4-hour middle, the Fibo 61.8% one-day and the SMA ten 4-hour.

Support two: $8,926 – This confluence is formed by the pivot point one-week support one, the pivot point daily support three and the Fibo 61.8% one-month.

Support three: $8,354 – This zone is home to the SMA 200 daily and the pivot point one-month support one.

Source: fxstreet.com