Central Banks Recommended to Ban Stablecoins

Central banks push for heavy-duty regulation of centralized, privately-issued global stablecoins and consider prohibiting decentralized ones. Fiat-pegged cryptocurrencies are coming under scrutiny, based on recommendations from the Financial Stability Board.

The Financial Stability Board (FSB) released a document addressing the regulatory, supervisory, and oversight challenges raised by global stablecoins. The document, although only consultative in nature, reveals disturbing plans for a globally coordinated move against stablecoins of all varieties.

The FSB makes ten high-level recommendations addressed to central banks and G20 authorities at the jurisdictional level. More specifically, they recommend a unified global approach to the supervision and regulation of the fiat-pegged cryptocurrencies.

Furthermore, the FSB suggests to authorities that, if they can’t control and regulate fully decentralized stablecoins, they should consider banning them.

FSB Raises Regulatory Alarms Against Global Stablecoins

The FSB’s primary focus is on the potential risks that stablecoins could pose to global financial stability, especially those targeted at retail investors. These fiat-pegged cryptocurrencies represent a risk to the financial stability of emerging markets and developing economies, read the document.

Moreover, the FSB argues that global stablecoins could pose significant governance challenges to central banks. The Board seems especially concerned with the macro-financial problems that could arise if, over time, citizens in both advanced and emerging market economies begin favoring stablecoins over existing fiat currencies.

The guidance is aimed at both advanced and emerging economies. Authorities in advanced economies are primarily concerned with stablecoins designed in a decentralized nature, seeing risks in their reliability as a store of value.

Jurisdictions in emerging market economies, meanwhile, express greater concern about foreign-currency-linked stablecoins substituting national currencies, retail deposits, or safe assets. They’re afraid that this could exacerbate bank runs and disintermediate the traditional financial institutions.

According to the FSB, another potential issue is that under distressed macroeconomic conditions—much like the current coronavirus pandemic—global stablecoins could essentially become a sort of a hybrid retail repo market for U.S. Dollars.

If left unchecked, global stablecoins could have a destabilizing effect on capital flows and local fiat exchange rates—especially so in emerging market economies, argued the international regulator.

Who Is the Financial Stability Board?

It is important to note here that, even though the FSB lacks formal legal power, its recommendations are still influential. One of its primary mandates is to monitor the systemic implications of financial technology innovations and the systemic risks arising from disruptions to central bank operations.

The Board is hosted and funded by the Bank for International Settlements (BIS). Its members are representatives of ministries of finance and central banks from all G20 member states, plus ten international organizations, including the IMF, BIS, ECB, the World Bank, and the European Commission.

In practice, the regulator holds a tremendous amount of clout.

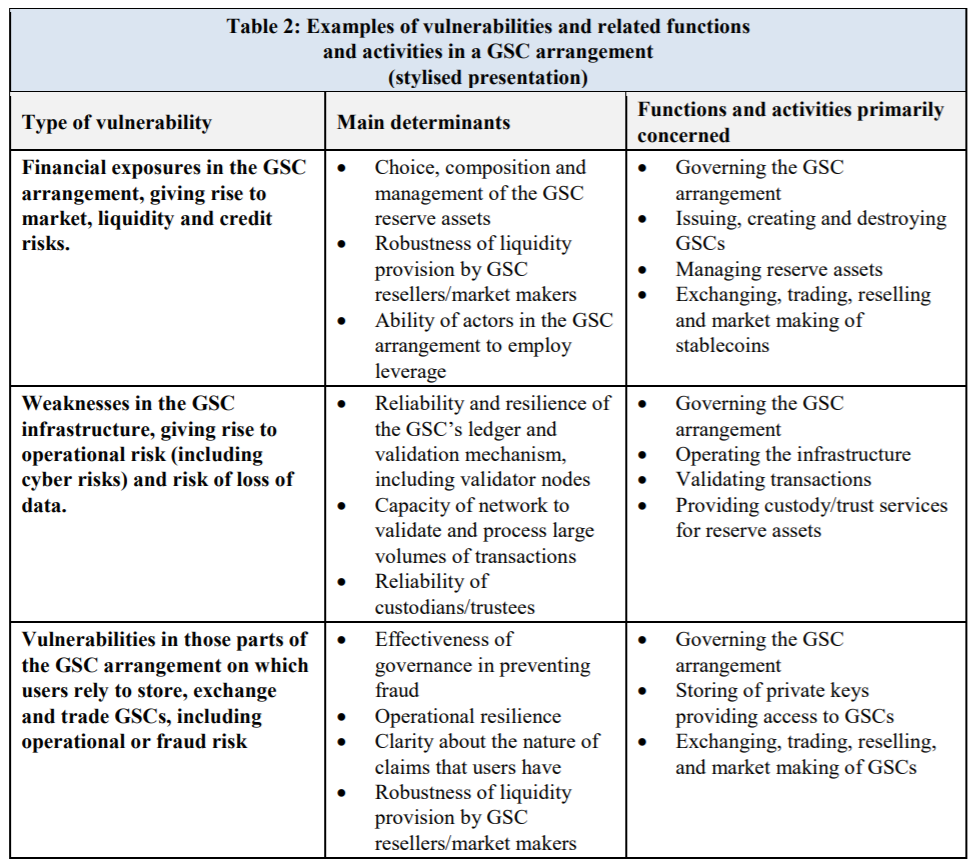

The objective of the FSB’s recommendations is to help authorities determine how to mitigate the potential financial risks caused by “global stablecoins,” or GSCs.

More alarming, it includes “other crypto assets that could pose risks similar to some of those posed by GSCs because of comparable international reach, scale, and use,” perhaps alluding to Bitcoin.

This isn’t the first reference to drastic action from the FSB. The regulator was asked to come up with specific recommendations on stablecoins back in February.

Recommendations on Stablecoins to Governments and Central Banks

The Board makes ten recommendations concerning the regulation of stablecoins, in the aforementioned document. Among them are a couple that may cause alarm in the cryptocurrency community.

“Authorities should have the ability to mitigate risks associated with or prohibit the use of certain or specific stablecoins in their jurisdictions where these do not meet the applicable regulatory, supervisory, and oversight requirements.”

The FSB recommends that relevant authorities should utilize necessary powers to regulate, control and even prohibit any and all activities related to operating, issuing, managing, providing custody, and the trade or exchange related to global stablecoins.

This could be dire for the likes of Tether and other international stablecoin operators. To make things clear, the FSB defines a global stablecoin as having “ potential reach and adoption across multiple jurisdictions and the potential to achieve substantial volume.”

“Authorities should apply regulatory requirements to GSC arrangements on a functional basis and proportionate to their risks.”

Christine Lagarde of the European Central Bank (ECB) refers to this principle as “the golden rule of supervision,” otherwise known as the “same business, same risk, same rules” approach.

This means that cryptocurrency issuers can no longer operate in a gray zone. Stablecoins will now have to play on a leveled playing field, adhere to the same rules as banks, e-money issuers, and large payment processors.

If central banks determine that particular GSC arrangements fit the definition of a “systemically important payment system,” then they’ll also fall under the Principles for Financial Market Infrastructures or PFMI.

“Authorities should ensure that there is comprehensive regulation, supervision and oversight of the GSC arrangement across borders and sectors. Authorities should cooperate and coordinate with each other, both domestically and internationally…”

The FSB is stressing the need for global unison in their approach to regulating and supervising stablecoins. The reason why this discussion is taking place at the highest levels of global economic governance is to mitigate possible risks of “regulatory arbitrage.”

In other words, this is the international banking cartel’s way of saying: If someone wants to operate a stablecoin arrangement out of Panama—sure, go ahead. But, they can only sell these stablecoins to Panamanian citizens.

“Authorities should ensure that GSC arrangements have in place a comprehensive governance framework with a clear allocation of accountability for the functions and activities within the GSC arrangement.”

Decentralized and Centralized Stablecoins Both Affected

The FSB goes on to explain that the degree of decentralization in GSC arrangements shouldn’t really matter in terms of the demand for regulation, supervision, and oversight.

At the same time, they imply that only permission-based stablecoins should be permitted to operate:

“Fully permissionless ledgers or similar mechanisms could pose particular challenges to accountability and governance and may not be suitable if regulators cannot be assured that appropriate regulatory, supervisory, and oversight requirements are satisfied.”

If the G20 adopts FSB’s views on this, it could also mean the end of Ethereum-based permissionless stablecoins. The entire DeFi sector shouldn’t be expected to fare much better, either.

“Authorities should ensure that GSC arrangements have in place robust systems for safeguarding, collecting, storing and managing data.”

This is simply the FSB saying that GSC businesses should give the G20 authorities “timely and unobstructed access to relevant data and information” on all stablecoin transactions and users. This it the same way traditional banks operate.

The critical question here is whether stablecoins running on permissionless blockchains are even able to do that.

Do wallet addresses and blockchain transactions count as relevant data and information?

Along the same lines, the FSB proposes that authorities should have the “ability to require a GSC arrangement to be governed in a manner that facilitates effective regulation and supervision, including by prohibiting fully decentralized systems.”

“Authorities should not permit the operation of a GSC arrangement in their jurisdiction unless the GSC arrangement meets all of their jurisdiction’s regulatory, supervisory, and oversight requirements, including affirmative approval (e.g. licenses or registrations) where such a mechanism is in place.”

In the broader context of the document, “operation of a GSC arrangement” can mean anything from registering a GSC legal entity to the sale of stablecoins to retail investors.

In that regard, if Tether, for example, wants to continue issuing USDT to citizens of G20 member states (or most of the world), they would need to obtain licenses and register with the relevant authorities in each and every G20 country. Given Tether’s current approach towards compliance, this may not prove practical.

The CTO of Tether, Paolo Ardoino, told Crypto Briefing:

“We welcome the Financial Stability Board’s recognition of the role of stablecoins in the global economy, and its consideration of financial technology innovation in the digital asset space.”

For stablecoin businesses like Tether, Circle, Paxos, Binance, and others this could prove dire because the costs of compliance with the above provisions are enormous. This could, more or less, leave banks as the only source of fiat-backed digital currency.

Potential Market Impact on Cryptocurrency

In terms of tangible legislation, the FSB’s recommendations, and its consequent impact on Bitcoin, will likely play out over the course of a few years.

In the meantime, it can be expected that central banks will increase cross-border cooperation to achieve greater supervision over stablecoin issuers and dealers.

Through this, the G20 aims to eliminate all feasibility of regulatory arbitrage and diminish what’s left of the regulatory wiggle room still remaining for stablecoin businesses.

As said by Richy Qiao, Chief Business Officer of decentralized stablecoin Ampleforth:

“This is something we’ve expected for a while. Large stablecoins that are centralized or tied to the financial system only work, until they matter. The FSB’s recommendations are inevitable and could result in the future of the entire crypto ecosystem coming under the control of those who control these types of regulated fiat-backed assets.”

Long-term Implications for Bitcoin and DeFi

Stablecoins play a leading role in the cryptocurrency ecosystem. The five largest stablecoins account for two-thirds of all trading volume, despite representing less than 4% of the market capitalization for public ledger tokens.

Rather than moving from crypto to fiat in a bank account, which is regulated and cumbersome by the industry’s standards, it’s instead possible to move into a fiat token that runs on a public blockchain. With USD stablecoins dominating the industry, this creates an extra level of efficiency for those in emerging and frontier markets.

With over 75,000 daily active addresses on USDT alone, the genesis stablecoin only lags behind Bitcoin and Ethereum in terms of adoption. In sum, the most important effect that stablecoins have had on the cryptocurrency markets is improved liquidity.

If the G20 heeds the recommendation put forth by the FSB, the stablecoin ecosystem, as people know it, will face immeasurable peril.

The first-order effect of this would be a dramatic reduction in liquidity for cryptoassets. The friction between a globally inefficient banking system and cryptocurrency exchanges will introduce hurdles in the timely deployment of capital.

Exchanges, market makers, and institutional lenders will bear the brunt of the crackdown. Binance’s top five trading pairs use USDT and represent 57% of the exchange’s volume, at the time of writing.

Given the expected erosion of liquidity, market makers may face diminishing workloads and more risk.

Trading pairs, for instance, would have to take place between two speculative tokens, rather than just one speculative token and one stablecoin pair.

Institutional lenders could see demand for funds dry up. Genesis Capital, an institutional lender, revealed that demand for stablecoins shot up from 9.6% in Q1 2019 to a whopping 37.2% in Q4 2019.

Of all the niches in crypto, DeFi—which has undue reliance on stablecoins—will be hit the hardest.

MakerDAO may have its entire business model come under heavy regulation, Compound could be eviscerated, and many of the other value-add services that leverage stablecoins could lose hard-earned traction generated over the last year.

Nine out of the top ten DeFi protocols, by value-locked, rely heavily on stablecoins in their operations. Moreover, exchanges that take advantage of regulatory arbitrage, like Binance, would be nowhere near their current size without stablecoins.

The other global stablecoins that are likely to fall under intense scrutiny if these recommendations are accepted include Facebook’s Libra, Bitfinex-associated Tether, and Circle’s USD Coin.

However, given the circumstances, this may prove favorable for exchanges, like Coinbase, who have gone great lengths to operate under the grace of U.S. regulators. It may also have the effect of pushing altcoin trading further into the sights of regulators, with more strenuous “anti-money laundering” and “know your customer” requirements, added Qiao.

The impact on the cryptocurrency ecosystem should not be understated. The entire crypto industry would be impacted if stablecoins were outlawed, Bitcoin included.

Pushing private stablecoins out of the game would make the implementation and adoption of central bank digital currencies much easier. As a result, it wouldn’t be far-fetched to think the G20 will favor this proposal.

In some ways, the industry is getting what it asked for—regulatory clarity. Central banks are finally shining a light on the regulatory gray zones that exist in the cryptocurrency markets. Though, this light may be a bit brighter than many would have asked for.

Reporting aided by analysis from Ashwath Balakrishnan. Interviews and supplemental quotes by Liam Kelly and Mitchell Moos.