Bitcoin’s Third Halving Will Be Its Biggest Test Yet

Bitcoin holders, developers, users, investors, and speculators are poised for the third Bitcoin Halving, which is merely days away. Slated for May 12th, the event will cut miner block rewards in half from 12.5 to 6.25 bitcoins, with new coins added to the network every 10 minutes. The annual inflation rate will be reduced from ~3.64% to ~1.8%, a notable milestone as it declines below the Fed’s inflation target of 2% per year.

Although the Halving has occurred just twice in Bitcoin’s 11-year life, historically the event has been followed by a massive rise in price of the dominant crypto asset. The first Halving occurred in November 2012 and Bitcoin experienced price appreciation of ~9,200% measured before the Halving to its cycle-high a year after the event. Similarly, the second Halving saw Bitcoin appreciate ~2,900% to reach its all-time high of $20,000 eighteen months after the event. However, it is impossible to derive statistically significant insights from two data points, and Bitcoin is facing a completely different macroeconomic environment this time around.

Two Sides To The Debate

Entering the Halving, analysts with opposing viewpoints occupy two main camps. The first camp argues the event is already priced in; the second believes the Halving is not priced in and will ignite the next bull market cycle. Proponents of the first cite the efficient market hypothesis, whereas advocates of the second point to supply/demand mechanics as well as the previous Halving market cycles.

HTTPS://BLOCKFOLIO.COM/

In short, the efficient market hypothesis posits that all information about publicly traded stocks is already factored into the prices of those stocks. Since the Halving is publicly known and has been for years, it would follow that market participants are expecting the event to be bullish, pushing the price up in the months leading up to the event with a higher expected future price discounted into the present.

Assuming the hypothesis is true, when exactly was the event priced in? At $10,000 in February, during the crash below $4,000 in March, or now as it approaches $9,000? Bitcoin’s volatility demonstrates market participants are unsure how to value the new asset and what its expected value should be post-Halving. Instead, the hypothesis may be best applied to more established asset classes, not a burgeoning one with little consensus for any valuation framework.

Basic supply-demand economics dictates a reduction in supply and constant demand would lead to a higher price. Demand for Bitcoin grows organically as individuals learn about its mechanics, network effects kick in, and new data surfaces displaying its resilience and performance as a store-of-value asset. Due to its liquidity and ease of storage and transfer, an entire lending industry has recently emerged enabling retail and institutional investors to use crypto as a form of collateral for loans. The crypto lending market has already exceeded $5 billion in loan originations in just two years.

Startups such as Fold, Lolli, Pei, Donut, and others are offering Bitcoin rewards on purchases or cash back to accumulate crypto. As these products gain market share, larger payment networks and credit card companies will start offering similar products and services. These apps naturally increase the number of Bitcoin holders and add recurring buy pressure, slowly building up demand.

New industries, products, and use cases will develop for Bitcoin as the asset matures, which will drive significant demand.

Bitcoin Is Fueled By Narratives

Beginning as a speculative digital collectible, evolving to digital gold now, and potentially transforming into a global medium of exchange and foundational layer of digital capital markets in the future, Bitcoin gains credibility as it moves through various stages of maturity. At the time of the last two Halving events, Bitcoin was an obscure digital collectible trading on unregulated exchanges with questionable security practices. As world leaders now voice their opinions on crypto and leading tech companies and banks scramble to issue their own digital currencies, Bitcoin has become a household name.

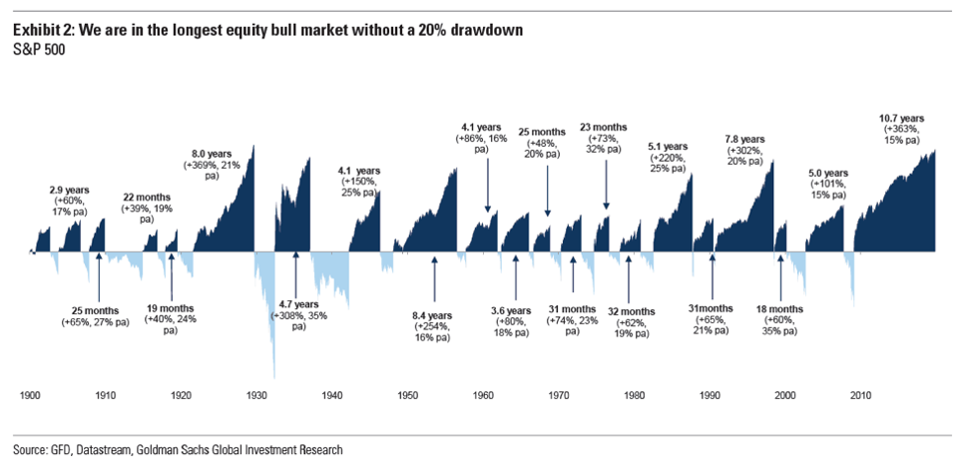

The last two Halvings happened during the longest bull market in modern history, spanning 11 years and all major asset classes. This time is completely different. The coronavirus-induced lockdowns have set the stage for a deep global recession, as demand for goods and services screeches to a halt. In response, the Fed announced it is ready to purchase unlimited amounts of treasury bonds and mortgage-backed securities. In other words: QE infinity.

To prevent a global economic meltdown in 2008, trillions of dollars were injected into the financial system, rewarding criminally negligent and greedy behavior. Concurrently, the seeds of a digital, supply-capped, immutable, censorship resistant, and non-sovereign store-of-value asset began to grow.

Bitcoin was built as a response to this fiscal and monetary opulence. As the only monetary asset with a truly predictable and capped supply, Bitcoin has the properties of a safe haven asset that should serve as a hedge against inflation, similar to gold. In order for it to fulfill its promise, Bitcoin must emerge post-crisis as a safe alternative to currencies whose values are eroding quickly.

Bitcoin was born in the wake of the last financial crisis, and it may come of age in this one. At the same time governments and central banks juice their economies with newly minted cash, Bitcoin’s Halving will cut new supply in half. Now is the time for Bitcoin to demonstrate if it is just another computer science experiment or a legitimate solution to our failing monetary system.