Bitcoin to Face Stronger Global Recession Than In 2009, IMF Forecast Shows (UPDATED)

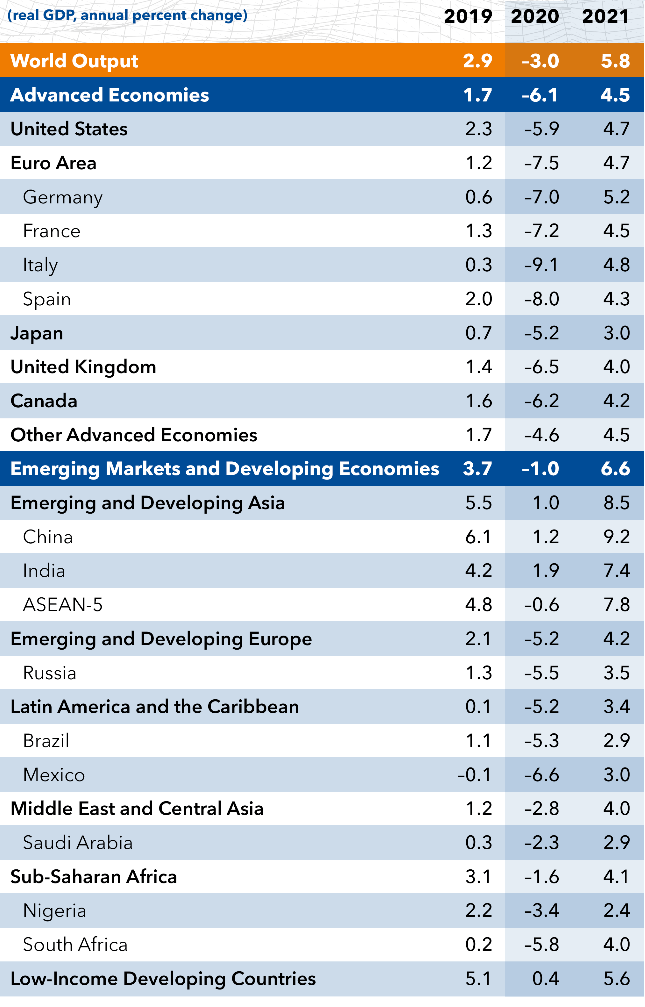

The global economy is estimated to drop by 3% this year, before rebounding by 5.8% in 2021, the International Monetary Fund (IMF) said today, stressing that “this crisis is like no other”.

In the past 60 years, the global economy decreased only once. In 2009, when Bitcoin started its journey, the global GDP slipped by 1.73%.

This time, advanced economies, such as the US, Euro Area and others might see the strongest drop, while the emerging markets and developing economies will suffer less and rebound faster, the IMF said in its latest World Economic Outlook, published today.

Marcus Swanepoel, co-founder and CEO of crypto exchange Luno, warned recently that in case of a massive global recession even the long-term hodlers may be forced to sell their bitcoin (BTC) to survive.

At pixel time (13:48 UTC), BTC trades at c. USD 6,903 and is up 3% in a day, trimming its weekly losses to less than 7%. Stocks also advanced on signs the coronavirus outbreak is possibly easing, while leaders across Europe weighed steps to exit quarantines.

“The forecast for the global economy laid out in this report reflects our current understanding of the path of the pandemic and the public health measures required to slow the spread of the virus, protect lives, and allow health care systems to cope,” Gita Gopinath, the Economic Counselor and Director of the Research Department at the IMF said in the report.

According to her, a partial recovery is projected for 2021, with above trend growth rates, but the level of GDP will remain below the pre-virus trend, with considerable uncertainty about the strength of the rebound.

“Much worse growth outcomes are possible and maybe even likely,” Gopinath added.

The IMF says that this crisis will need to be dealt with in two phases:

- a phase of containment and stabilization

- the recovery phase.

Meanwhile, the Counselor also noted that in emerging markets and developing economies with large informal sectors, new digital technologies may be used to deliver targeted support. Central bank digital currencies (CBDCs) can make the monetary system faster and more efficient.

Bitcoin might find its way

Gary McFarlane, a cryptocurrency analyst at interactive investor, a UK-based investment platform, says that it’s difficult to square V-shaped economy recovery hopes with the IMF forecasts and perhaps more pertinently, the progress of the coronavirus.

“For as long as there isn’t a vaccine, consumer behavior will change for the worse as far as demand is concerned, so this bear market could be just getting going and that would be bad news for bitcoin,” he told Cryptonews.com, reminding that new pandemic waves are also possible.

However, according to him, a launch of a central bank digital currency or Facebook‘s Libra, emergence of a new “crypto killer app,” might help BTC that could also be used “in the most distressed economies as a store of value when all other alternatives lack credibility and, perhaps most importantly, portability.”

Despite its volatility, as a last resort bridging currency alternative for narrowing fiat options in certain economic scenarios, bitcoin could still find a near term use case.

“And that includes in the advanced economies too, as investors worry about the burgeoning debt mountains and their sustainability over time,” the analyst said.

Tom Lombardi, Director at Wave Financial Group, a Los Angeles and London based digital asset investment management company, also stressed that “as the supply of money increases but the level of productive outcomes is unchanged (more likely to decline in 2020), the dollar value of hard assets with supply constraints such as gold and bitcoin are likely to increase.”

“Flight to safety has supported gold prices,” the IMF report says. Bitcoin is e-gold with more efficient properties of free storage, near free transfer, and free of government intervention during a period of political overreach of civil liberties,” Lombardi said.

He also added that because of the widely publicized dollar shortage in the world (countries’ debts are dollar-denominated), there is a short squeeze on the dollar that is unrelated to the pandemic crisis, pushing up the price of USD.

“This has been happening since 2013. Once this secular shift wanes, investors should expect inflation expectations not seen since the late 70s,” the Director said.

Meanwhile, Jehan Chu, Co-Founder & Managing Partner at Kenetic Capital, said that he expects BTC “to gain ground as a viable alternative asset as institutional investors sour on weak markets, stillborn IPO’s, and all-you-can-eat quantitative easing.”

“Look for bitcoin to gain momentum leading into the May halving event, and to recover near all-time high levels by end of the year,” he said