Bitcoin Price Analysis: Bitcoin halving dilemma surge to $19,800 or nosedive to $4,000 – Confluence Detector

Bitcoin is currently exchanging hands at $8,683 at the time of writing. The price has recovered slightly from the dip to $8,100. An intraday high has been achieved at $8,812 (short term resistance level). Glancing further up $9,000 is the next resistance; that if broken could pave the way for the leg up to the critical resistance at $10,120 (previous week high).

In the event $10,120 is broken riding on high trading volume, the following target is $10,650 (a very strong seller congestion area). Most traders anticipate that if $10,650 is broken, rally to new all-time highs would come into play.

On the flip side, if the rally is rejected at $10,120 post-halving, Bitcoin is likely to spiral under the recent support at $8,100 and refresh levels in the $7,000’s range. It is vital that support at $7,800 holds for a bullish scenario. However, if broken BTC/USD could nosedive to $6,000 and you can expect a retest of $5,200 and $4,000 support areas respectively.

In the meantime, reward halving is to take place in less than 24 hours. Bitcoin dumped to $8,100 two days before the event; the fall is likely to allow more people to join the market. However, resistance under $9,000 continues to limit the bulls’ efforts.

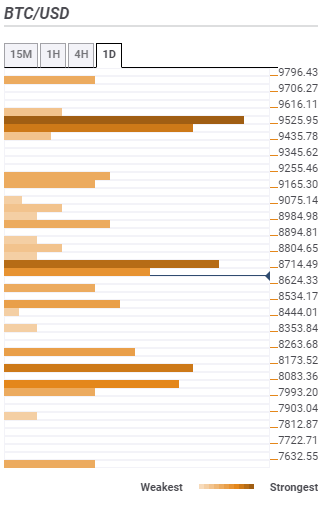

Bitcoin confluence resistance and support areas

Resistance one: $8,714 – as highlighted by the previous low 4-hour, Fibonacci 23.6% one-month, the Bollinger Band 15-minutes middle and the 100 SMA 15-mins.

Resistance two: $9,525 – Is the zone where the Fibonacci 38.2% one-week and the pivot point one-day resistance one converge.

Support one: $8,534 – Highlights the Fibo 23.6% one-day and the Bollinger Band one-day middle curve.

Support two: $8,173 – Home to the previous low one-day.

Source: fxstreet.com