April Loves Bitcoin, But Watch for Capitulations and COVID-19 – Kraken

While April has historically been the second-best performing month for bitcoin (BTC), investors should watch for the possible miner and/or holdler capitulation and how the world is dealing with the COVID-19 pandemic-triggered economic crisis, according to analysts at major crypto exchange Kraken.

On average, in April, BTC posts a +53% return and has the highest median return at +27%, the exchange said in its monthly volatility report, released this week. Also, this month is on average 48% more volatile than March. As a reminder, this past month, marked with a market crash, was the most volatile March in history and the 8th most volatile month since January 2011.

Meanwhile, Kraken also reminded that higher bitcoin prices are essential in order to keep miners in business and that even “sideways price action” could be all it takes to “squeeze unprofitable miners out of the market” and the players leaving the game might decide to liquidate any bitcoin and other assets they hold. “Bitcoin’s halving in May could exacerbate this dynamic should price fail to trend higher,” the report warned.

Today, BTC dropped below USD 7,000 again. At pixel time (12:48 PM UTC), it trades at c. USD 6,939 and is down by 4% in a day, trimming its weekly gains to 0.5%.

Further, the exchange also noted that 58% of the bitcoin supply hasn’t moved in more than a year. Should this number decrease, it might mean that long-term holders “have lost confidence in bitcoin and have exited the market.”

Moving over to the current economic climate, Kraken’s researchers said that the COVID-19-triggered economic crisis is not in itself a good thing for bitcoin, and that it could in fact lead investors to sell the asset:

“Growing unemployment, falling asset values, illiquidity, worsening credit conditions, and fear, among all else, could drive cash-strapped market participants to sell bitcoin,” the report said, noting that although stimulus from central banks and governments could “spill over into bitcoin, relief is not guaranteed and would most certainly not be realized overnight.”

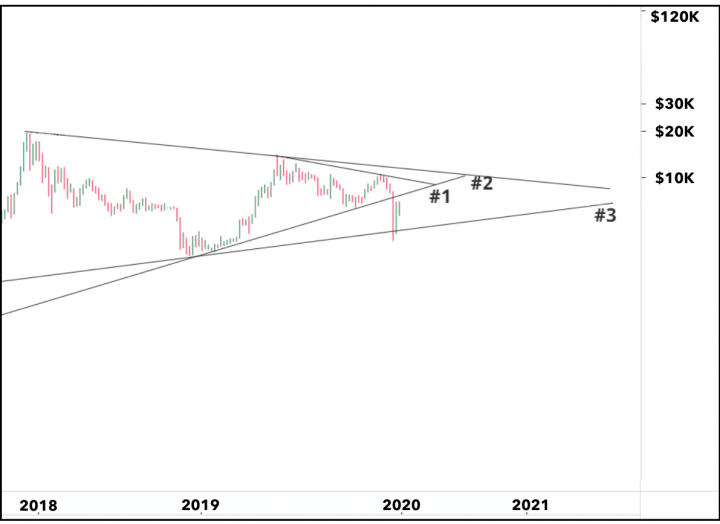

Looking at the current chart set-up for bitcoin, Kraken’s report outlined three different scenarios for the price, but made it clear that scenario #3 best represents the current situation, given the sharp drop through the major trendline (#1) that occurred in mid-March.

“Although one could argue that the break of support has initiated the start of a bear market and foreshadows incremental volatility in the weeks & months ahead, others believe the “pennant” pattern formation remains intact,” the report said, referring to trendline #3 in the chart.