Bitcoin to See More Volatility as Indicator Foreshadows A Price Reversal; Could See a Big Spike

Today, Bitcoin is in the green, currently trading above $11,585.

The recent price trend of the largest cryptocurrency suggests bitcoin is consolidating before making the next jump. This move could see us going back to $12,000, a resistance level that dates back to last August and was rejected this weekend.

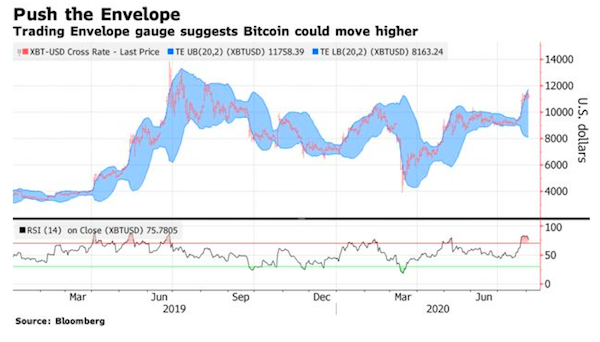

According to the 14-day relative Strength Index (RSI), the digital asset is in overbought territory.

“The break above $10,000 is very compelling and should lead Bitcoin higher,” said Matt Maley, chief market strategist for Miller Tabak + Co. But said in the near term, it is overbought and, as such, needs to take a breather.

“It might be able to work off this condition with a sideways correction, but its upside potential is limited over the next week or two,” he said.

The Trading Envelope indicator, which maps out higher and lower limits, has the price of the coin below the band’s upper limit, which is a positive development.

After the weekend’s bout of volatility, Bitcoin has made an impressive recovery this week. But despite the price swings, “Bitcoin’s perp funding rates have come down by a significant amount as a result,” said Denis Vinokourov of Bequant.

However, “even though the futures term structure has been stretched yet again, there doesn’t appear to be an immediate threat from this factor alone.”

The good thing is bitcoin’s market cap has surged to new 2020 highs, and growing usage of the network adds to the evidence of a “rising bull market.”

Over the past week, BTC also averaged more than 1 million daily active addresses for the first time since January 2018. BTC daily transaction fees are also catching up by growing 67.4% week-over-week.

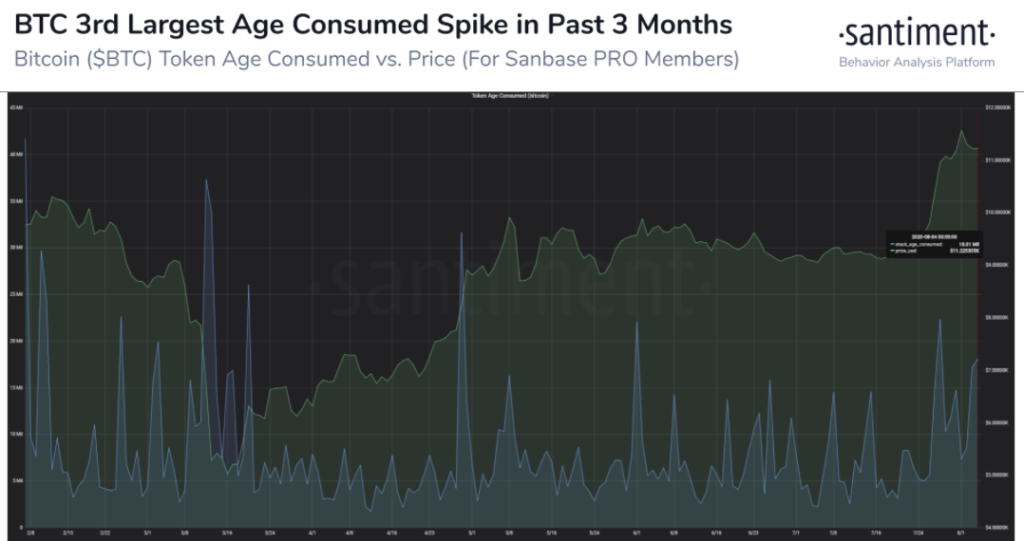

On top of this, bitcoin has its third-largest token age consumed spike since April. This indicates a potential short or mid-term price direction change and an increase in volatility, which means a higher chance of BTC bouncing back toward $12,000 than going downside.

“Volatility is coming. More likely to the upside than down, because this indicator more often than not foreshadows short-term to mid-term price reversals,” noted crypto data provider Santiment.

The market is currently “entering another period of capital rotation,” which is driven by the price consolidation by bitcoin.

The fact that bitcoin has broken above $10,000 is important, and a weaker dollar could be further aiding it, said Craig Erlam, senior market analyst at Oanda. “This could leave it open to further gains and surges in volatility in the months ahead.”

Source: bitcoinexchangeguide.com