As US Seized Gold in 1933, Is There a Threat to Bitcoin in the 2020s?

A sharp global recession seems to be inevitable. Could the US or any other government shut down crypto exchanges or ban the ownership of cryptoasset?

At first glance, this seems like an extreme and unlikely scenario. However, figures within the crypto industry believe that it could become a real possibility if, in the US case, USD suffers severe inflation during a long recession.

By closing exchanges and custodian services, the US government would attempt to limit the number of people exchanging increasingly devalued USD for bitcoin (BTC) and other coins.

However, while there’s an outside chance that the US government might move to close exchanges and ban the ownership of crypto, it’s unlikely that any such move would be effective in stopping Americans from holding and trading crypto. That is, so long as they moved their coins off any US-based third-party platforms before the government swooped in. In theory, the same scenario would play out in other countries too.

Executive Order 6102

On March 12, Messari founder Ryan Selkis tweeted a warning to his 100,000 followers:

By “FDR era,” Selkis is referring to former president Franklin Delano Roosevelt. On April 5, 1933, in the midst of the Great Depression, Roosevelt issued Executive Order 6102, which decreed that all US citizens “are required to deliver […] all gold coin, gold bullion, and gold certificates now owned by them to a Federal Reserve Bank, branch or agency.” The hoarding of gold, similar to the stacking sats, was forbidden back then in order to help the Federal Reserve to increase the money supply during the depression. Also, a penalty of USD 10,000 and/or up to five to ten years imprisonment were introduced.

However, back then, the Federal Reserve Act still required 40% gold backing of Federal Reserve Notes issued, while today the US dollar is not backed by gold (or BTC for that matter).

In either case, it seems that Selkis is concerned that the Trump administration would do for cryptoasset what FDR did for gold. And it would seem that a number of other people working within the crypto industry agree with him.

Speaking to Cryptonews.com, CryptoMondays partner Lou Kerner agrees that the need to limit the impact of crypto hoarding on fiat monetary systems might impel the US government (and possibly other governments) to close down exchanges or even seize crypto.

“The most popular reason used by governments is to ban the use of cryptocurrencies and the services that support their use is illicit activity,” he says. “But it’s broadly believed that governments are most concerned about the impact it could have on their own monetary system if citizens had choice.”

Indeed, other governments have taken harsh restrictive measures against crypto for reasons related to capital controls. Most notoriously, the Chinese government banned crypto exchanges (not BTC) in 2017, largely due to fears over capital flight (i.e. people sending or trading money overseas).

So it’s certainly not inconceivable that other governments – including the US government – could take similar steps if the coronavirus pandemic triggered recession results in a deep depression and high USD inflation. While hyperinflation is not likely in the US, some estimate that the USD may devalue in the next 12 months.

Current exchange outflows

Given that this threat can’t be dismissed, voices within the industry recommend taking crypto off third-party platforms wherever possible.

“Not your keys, not your coins, is a popular phrase because governments can always seize your assets, whether its on a crypto exchange, or at Chase Bank,” says Lou Kerner, who agrees that traders should seek to use their own wallets with their own private keys in order to safeguard their crypto.

In fact, it would seem that some traders are already beginning to move crypto off of exchanges. As reported, BTC outflow from exchanges has been growing daily since March 18.

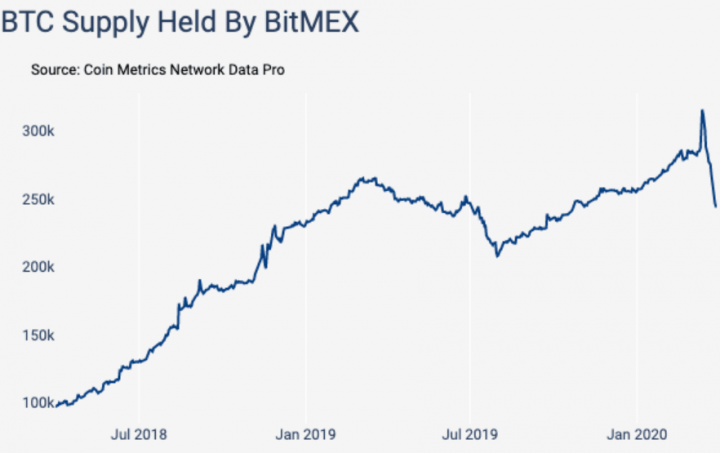

Likewise, Coin Metrics recently said that BitMEX has experienced “mass liquidations” since March 13, with its holdings of BTC falling by 22%.

It’s hard to confirm whether this exodus is happening because people fear government action. Asked whether people were preparing for possible closures or seizures, Lou Kerner suggests that the outflows may be caused by a variety of reasons.

“There are lots of crosscurrents going on at the same time. Hard to know exactly what’s going on,” he says. “Whales tend to have their own wallets. So it could be that whales are owning a larger percentage of the coins.”

And obviously, with 6.6 million people claiming for unemployment in the United States, it could be that more people are liquidating their crypto in order to put extra USD in their pockets. Marcus Swanepoel, co-founder and CEO of crypto exchange Luno, warned recently that in case of a massive global recession even the long-term hodlers may be forced to sell their BTC to survive.

‘It largely doesn’t matter’

But even assuming that, in the worst-case scenario, the US government does attempt to shut down US-based exchanges and prohibit cryptocurrency ownership, will this make a massive difference? Wouldn’t a ban on bitcoin and other cryptoassets be more or less unenforceable?

“Governments do what they believe is in their best interests,” says Lou Kerner, agreeing that a ban could be a possibility. “I think the important point is that it largely doesn’t matter. China has banned Google and Facebook and Twitter. But they’re still things.”

Again, in the case of China, the government’s banning of cryptoexchanges hasn’t prevented Chinese people from owning cryptocurrencies and trading them on various platforms, including over-the-counter (OTC). For example, according to a small poll conducted by PANews in October 2019, 8% out of 300 surveyed Chinese students hold some kind of cryptoasset, while 17% in total have held crypto at some point.

So even if the US government succeeded in shutting down US-based exchanges, US citizens and residents would technically still be able to trade crypto on international, decentralized, peer-to-peer platforms. And even if the government banned ownership of crypto outright, it would still be hard to trace crypto held on private wallets. Moreover, without regulated crypto exchanges that know who their customers are it would be even harder to track crypto owners. (Let’s hope the government won’t get access to a user database on your exchange.)

To conclude, while it seems that the general consensus is that crypto bans are not 100% effective, it doesn’t mean that it can’t hurt. Just stay vigilant and remember – not your keys, not your coins.