3 REASONS WHY BITCOIN DEFIED BEARS, SUDDENLY RALLYING 10% TO $7,800

Bitcoin has done extremely well over the past 24 hours. After falling as low as $6,800 on Wednesday, the cryptocurrency mounted a strong comeback on Thursday morning, rallying from $7,050 to $7,800 in an explosive fashion to mark an over 10% gain. (As a note: some of that rally has since been reversed as bears have tried to reassert control.)

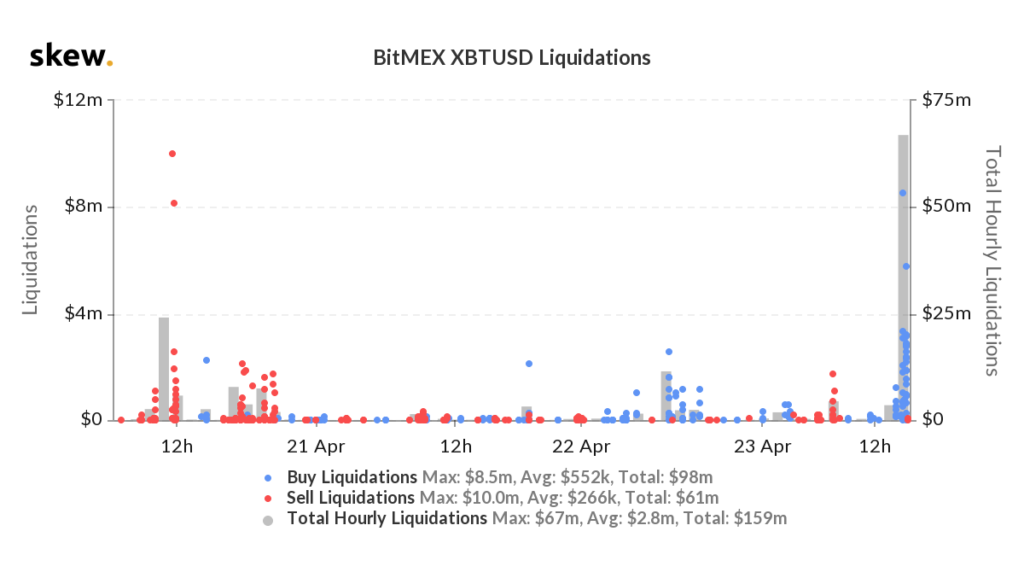

It was a move that caught many traders off guard. Case in point: data from Skew.com, which tracks crypto derivatives, registered that nearly $70 million worth of short positions on BitMEX was entirely liquidated during the move — the largest amount of daily liquidations in a month.

BITMEX’S BITCOIN FUNDING RATE WAS NEGATIVE

As shared by trader and economist Alex Krüger, the Bitcoin funding rate on BitMEX — which is the amount that long positions pay short positions — has trended negative ever since the March 12th “Black Thursday crash.”

Source: bitcoinist.com