THE SIMPLE REASONS WHY THIS TRADER IS CAUTIOUS OF ETHEREUM

Ethereum has been flashing signs of weakness as the entire cryptocurrency market continues losing the momentum that had been established over the past several days and weeks.

This lack of momentum does seem to suggest that further downside could be imminent. Buyers are, however, attempting to defend the lower boundaries of the trading ranges that ETH, Bitcoin, and other altcoins have formed over the past few weeks.

Whether or not these levels are broken below in the near-term may depend primarily on just how potent the imminent selling pressure from miners is in the days and weeks ahead.

One previously bullish analyst explained that he is growing cautious of Ethereum and Bitcoin due to this single factor.

ETHEREUM’S OUTLOOK DIMS AS IT NEARS CRUCIAL SUPPORT

At the time of writing, Ethereum is trading down just under 2% at its current price of $231. This is just a hair above the crucial support it has formed at $230 over the past several weeks.

This level happens to mark the lower boundary of the trading range that has been firmly established between $230 and $250. Earlier this week, buyers attempted to break $250, but it posted a swift rejection at this level.

One factor that could influence how it trends next is seen while looking towards wallets associated with the now-defunct PlusToken scam.

Data shows that they just moved 800k ETH – potentially signaling that a massive amount of selling pressure is about to be placed on the market.

“Ethereum’s on-chain transaction volume just spiked to its highest level since the Black Thursday dump! The increased activity appears connected with PlusToken – a known Ponzi scheme – moving almost 800k ETH on the blockchain,”

analytics firm Santiment noted in a recent tweet.

WHY ONE PREVIOUSLY BULLISH ANALYST IS GROWING CAUTIOUS ON ETH

PlusToken isn’t the only potential source of immense Ethereum selling pressure.

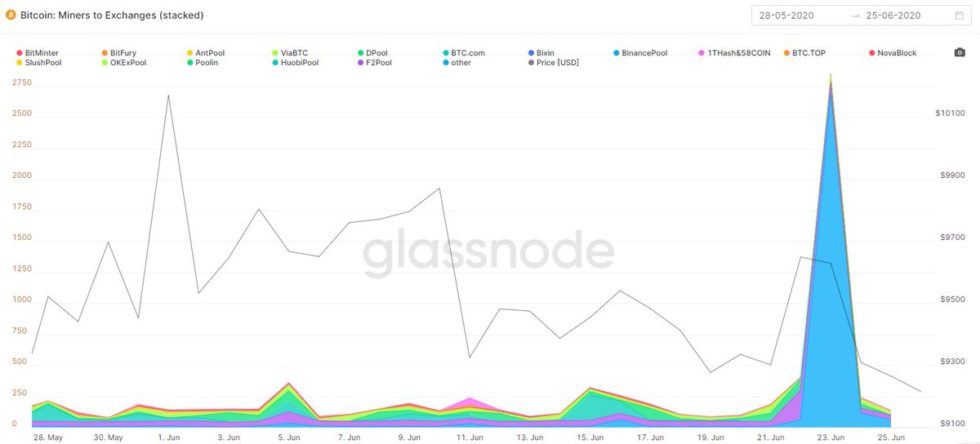

One analyst recently explained that although he remains highly bullish on Ethereum and Bitcoin over a long-term time frame, he is cautious about their near-term price action due to large miner outflows in recent times.

“Personally increasing my exposure to USDT here… While I am super bullish on both BTC & ETH over the next 12/24 months, over the past week there has been a huge spike in miners moving funds on exchanges… This is usually followed by large drops in PA, be careful!”

He warned.

Source: bitcoinist.com