Bitcoin price crash: Possible reasons for correction of more than $1,000

- The Bitcoin price rate has plummeted from $19,450 to $17,200 within a few hours and can currently stabilize at $17,950.

- Analysts say that the long-term on-chain indicators remain bullish and BTC can again test $20,000.

The Bitcoin price reached a new year high of $19,450 and was close to its former all-time high of over $20,000. Within a few hours, however, Bitcoin showed a strong correction, with the price falling briefly to $17,200. At the time of writing, BTC was able to stabilize at $17,950. The market capitalization has fallen to $332.19 billion.

Many analysts have warned of a correction, including Bitcoin bull Brian Kelly and trader Tone Vays. In a new podcast yesterday, Vays predicted a correction up to $14,000. In addition, some metrics also point to a price decline, although it is likely to be mild. The “Crypto Fear and Greed Index” was at record levels throughout November, indicating that investors are too “greedy”.

Furthermore, the correction was accompanied by an increase in large-volume BTC transactions on various exchanges, so that some whales probably wanted to take their profits shortly before the $20,000 mark and thus put pressure on the price. Ki Young Ju, founder of the on-chain analysis service CryptoQuant, said on Twitter that more and more whales are sending BTCs to exchanges, but that the long-term on-chain indicators remain bullish:

All Exchanges Inflow Mean increased a few hours ago. It indicates that whales, relatively speaking, deposited $BTC to exchanges. But long-term on-chain indicators say the buying pressure prevails. I still think we can break 20k in a few days.

The crash may also have been influenced by tighter regulation of self-hosted crypto-wallets by US Treasury Secretary Steven Mnuchin. Coinbase CEO Brian Armstrong stated that if the new regulations announced yesterday come into force, this could be a major setback for Bitcoin and the crypto market:

If this crypto regulation comes out, it would be a terrible legacy and have long standing negative impacts for the U.S. In the early days of the internet there were people who called for it to be regulated like the phone companies. Thank goodness they didn’t.

Meanwhile, data analysis firm Santiment describes that Bitcoin is still drawing bullish indicators, but there are some metrics that point to a short-term correction. The Bitmex fundig rate is currently still positive, which means that there are more long positions on the derivatives exchange than short positions. In the past, however, it is precisely in such situations that strong corrections have occurred, with all long positions being liquidated by a sell-off. Santiment states that BTC can continue to grow, but traders should be vigilant:

There’s probably some further room for BTC to grow, but it’s worthwhile to keep an eye on the sudden spike in positive funding rate (if it happens), as a warning sign for possible top.

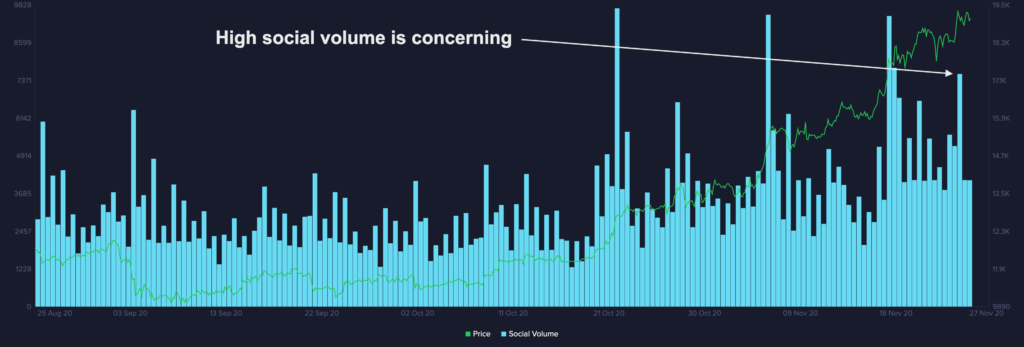

In addition, activity on social networks has risen to a local high, which also indicates an overheated market. As soon as the majority of investors become nervous, the peak could be reached and a corresponding correction could follow:

… a sudden flip of the crowd to Longs and spike in Social volume will likely be the top as the crowd gets excited.

Despite some indicators pointing to a correction, it remains to be seen whether Bitcoin will continue to fall or continue the upward trend of the last weeks, Santiment said.

Source: crypto-news-flash.com