$13,000 Is The “Most Important” Level For Bitcoin On a Macro Scale

Bitcoin’s recent push higher has made some investors look ahead, speculating as to what comes next if the leading cryptocurrency manages to set new year-to-date highs.

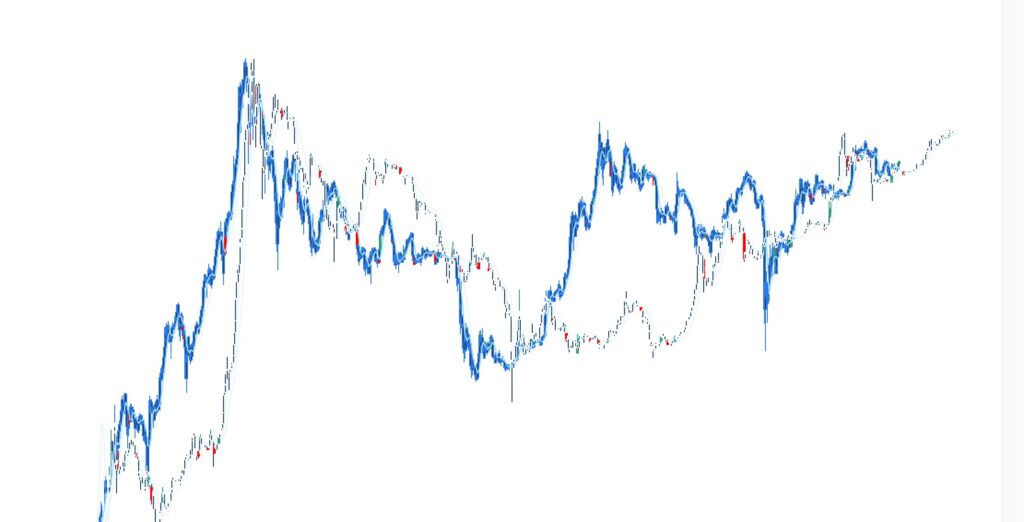

One crypto-asset trader believes that should BTC surmount its summer highs of $12,500, $13,000 will be crucial to watch. The trader shared the chart below on October 8th, which shows BTC’s price action since the 2017 lines with $13,000 and the prices in that vicinity highlighted.

Explaining why $13,000 is so relevant, the analyst who shared the chart wrote:

“IMO $13’000 is the most important $BTC macro level. 1) Rejected 2018, pulled back to 3k. 2) Rejected 2019 before flashcrash to 3k. 3) Tested once in 2020 since price recovery. Push and hold through for a while (not just a fence) would make me believe in ATH. A man can dream.”

Some think that $14,000 may be of more importance due to it marking the exact highs of 2019’s rally. $14,000 also marked where BTC’s December 2017 candle closed, not $20,000 as some may expect.

It can be said that the resistance between $13,000 and $14,000 is important

Bitcoin is expected to soon move towards $13,000, some analysts have suggested.

One analyst recently noted that if you overlay the last macro market cycle for BTC on top of current price action, it is clear that a move towards $13,000 will soon be had:

“Can’t get enough of this overlay. Each candle is adjusted to reflect the percentage drop not price. And it fits like a glove.”

Should Bitcoin push to $13,000 or $14,000, it remains to be seen if it will confirm that level as support.

Source: bitcoinist.com